The smart Trick of Feie Calculator That Nobody is Talking About

Table of ContentsA Biased View of Feie CalculatorThe Buzz on Feie CalculatorUnknown Facts About Feie CalculatorFeie Calculator - The Facts4 Simple Techniques For Feie Calculator

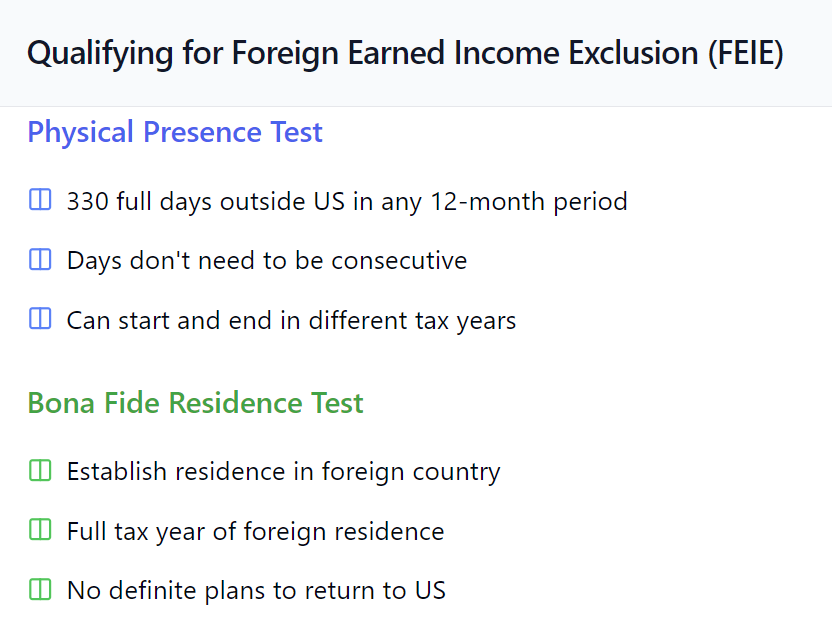

Initially, he offered his united state home to establish his intent to live abroad completely and requested a Mexican residency visa with his wife to aid meet the Bona Fide Residency Examination. Additionally, Neil protected a lasting residential or commercial property lease in Mexico, with plans to ultimately buy a building. "I currently have a six-month lease on a residence in Mexico that I can prolong an additional six months, with the intent to buy a home down there." Neil points out that getting building abroad can be challenging without first experiencing the location."We'll absolutely be outdoors of that. Even if we return to the United States for medical professional's appointments or business telephone calls, I doubt we'll invest more than thirty days in the US in any offered 12-month duration." Neil emphasizes the value of rigorous tracking of united state gos to (Bona Fide Residency Test for FEIE). "It's something that individuals need to be truly thorough regarding," he says, and suggests deportees to be cautious of common blunders, such as overstaying in the united state

Feie Calculator Can Be Fun For Anyone

tax responsibilities. "The reason united state tax on globally earnings is such a huge deal is because many people neglect they're still based on united state tax obligation also after moving." The united state is just one of minority nations that taxes its citizens regardless of where they live, suggesting that also if a deportee has no earnings from U.S.

income tax return. "The Foreign Tax obligation Credit history enables individuals working in high-tax nations like the UK to counter their united state tax obligation by the quantity they've currently paid in tax obligations abroad," says Lewis. This makes sure that deportees are not taxed two times on the same revenue. Nonetheless, those in low- or no-tax countries, such as the UAE or Singapore, face extra obstacles.

The Buzz on Feie Calculator

Below are some of the most often asked inquiries regarding the FEIE and various other exemptions The International Earned Income Exemption (FEIE) permits U.S. taxpayers to omit as much as $130,000 of foreign-earned earnings from government income tax, lowering their U.S. tax obligation. To receive FEIE, you should satisfy either the Physical Visibility Examination (330 days abroad) or the Bona Fide House Examination (prove your primary house in a foreign nation for an entire tax year).

The Physical Existence Test likewise requires U.S (Digital Nomad). taxpayers to have both an international income and a foreign this post tax obligation home.

Feie Calculator Can Be Fun For Anyone

An earnings tax treaty in between the united state and another nation can aid protect against dual taxation. While the Foreign Earned Revenue Exemption decreases taxable revenue, a treaty may supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Report) is a called for declaring for U.S. residents with over $10,000 in foreign monetary accounts.

Qualification for FEIE depends on conference details residency or physical presence tests. He has over thirty years of experience and currently specializes in CFO services, equity compensation, copyright taxes, marijuana taxes and divorce related tax/financial planning issues. He is an expat based in Mexico.

The international gained revenue exemptions, occasionally referred to as the Sec. 911 exemptions, omit tax obligation on salaries gained from working abroad.

The Greatest Guide To Feie Calculator

The tax obligation advantage leaves out the revenue from tax obligation at lower tax prices. Formerly, the exclusions "came off the top" minimizing revenue subject to tax at the leading tax rates.

These exclusions do not exempt the salaries from US tax yet just give a tax obligation decrease. Keep in mind that a bachelor working abroad for every one of 2025 that gained concerning $145,000 without any other income will have gross income minimized to zero - efficiently the exact same response as being "tax cost-free." The exemptions are calculated on an everyday basis.